WE WANT TO—

accelerate India’s economic growth.

The best way to do this? Offer financial freedom to the masses.

We want everyone to have access to any financial service like loans, insurance or investments.

Sadly, that’s not the case today—

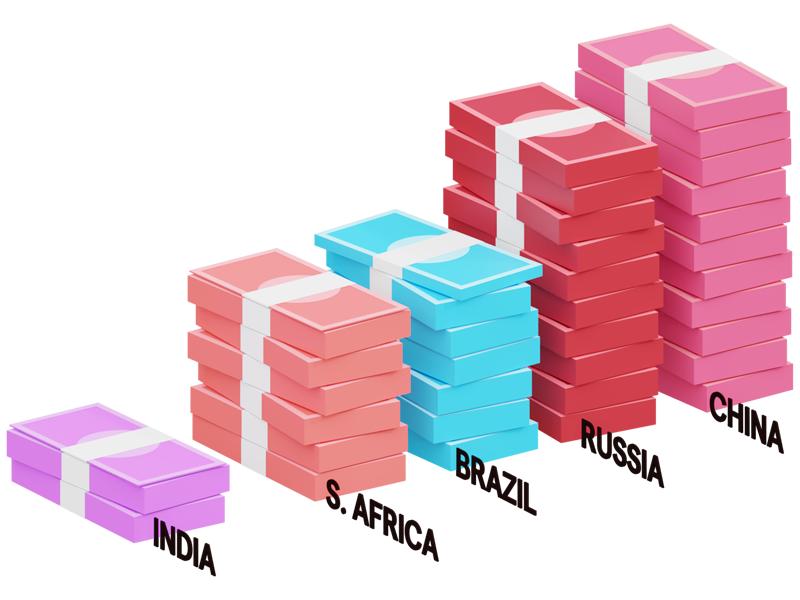

We are a poor country

Access to formal loans is dismal

Most can’t afford insurance

Financial services that we take for granted, are available to less than 5% of the population.

The under-penetration of loans, insurance, credit cards, mutual funds, stocks is what makes India a still-poor country.

We want to change that.

Easier said than done, no? But hear us out. We have a plan. ↓

1.

First, we’ve identified the basic building blocks of our economic engine.

That’s the easy part. They are—

PAYMENTS

DATA

LENDING

INVESTMENTS

These four categories alone constitute a significant majority of financial transactions in the country.

This means that we can cover a lot of use-cases by solving problems in these categories.

2.

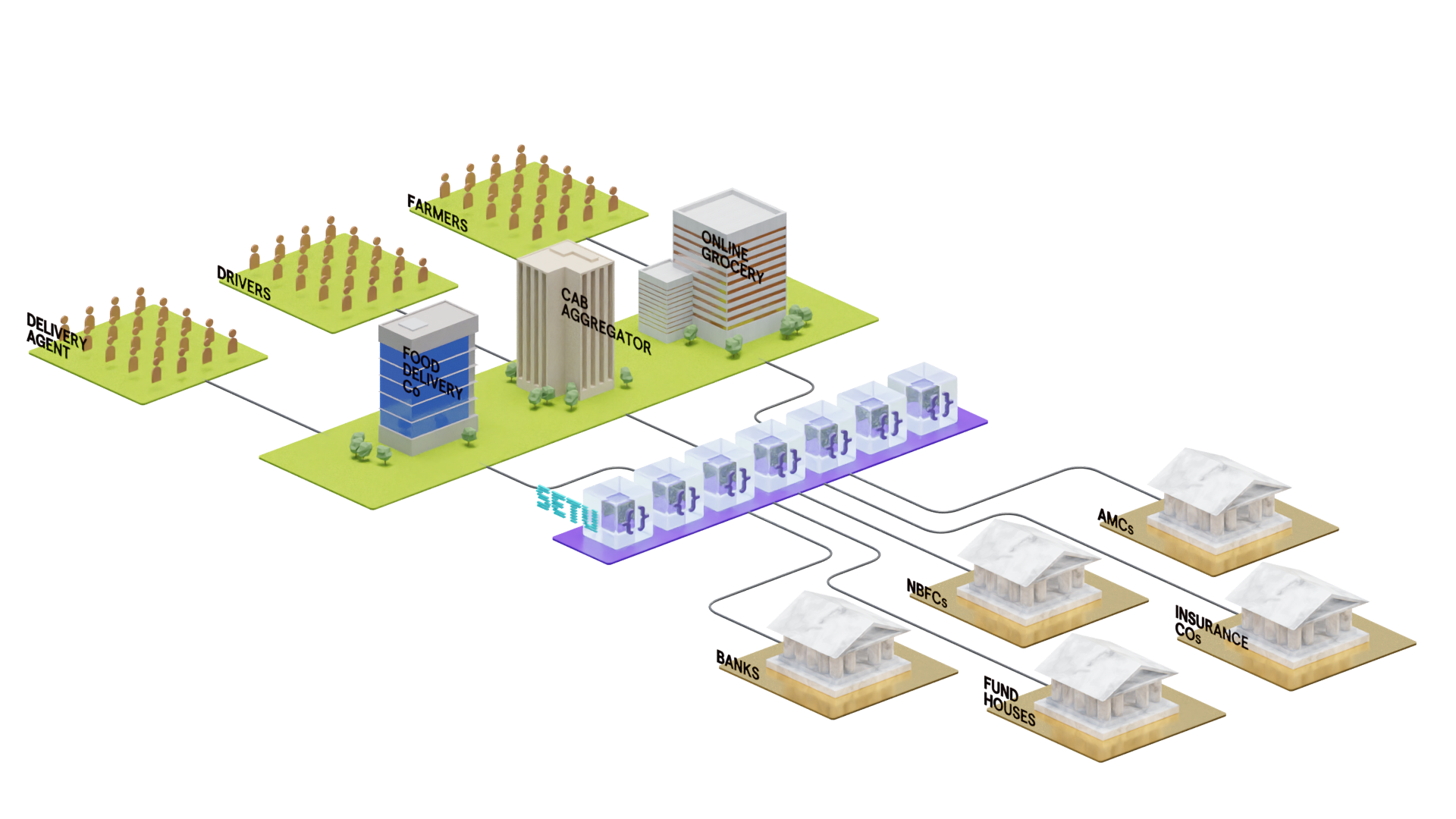

Next, we work with banks, NBFCs, and other institutions to reinvent the services they offer.

For loans, insurance, fixed deposits etc—there isn’t much flexibility in how they are offered to and consumed by end-users.

A loan product built for farmers would not be well-suited for the income cycle of, say, a food-delivery person.

There is no “one” India.

For a country like ours, diversity is both our boon and bane. This means a one-size-fits-all approach is doomed to fail. It just doesn’t work.

Customisation is paramount.

So, we need customisable financial products and reduce the cost of distribution. This, at scale.

What would be the best way to do all that? Any ideas?

There is only one answer—

APIs.

Adopting digital financial infrastructure also reduces costs, by orders of magnitude.

The cost of on-boarding, verifying customers and transacting goes from thousands of rupees to mere paise. And it makes way for some really novel products.

Imagine a world with week-long, low interest loans. Or mutual funds that could be bought with spare change. Daily, small-ticket recurring deposits could become commonplace.

This is nothing short of a revolution.

3.

We expose our APIs to companies that cater to a multitude of cohorts

We work with companies that cater to food delivery folks, cab drivers, small businesses and more. With our APIs, they can build highly-customised financial products. The APIs are raw ingredients, and companies can create any recipe as per their needs.

And the best part is, they don’t have to worry about regulation, compliance and all that red tape—thus freeing them up to innovate further.

Finally, we offer those same APIs in pre-built packages—SDKs, embed-and-forget screens, white-labelled frameworks and whatnot.

We basically want to remove the entry barrier for anything fintech—any company should be able to offer financial services, in whatever way suits them and their users best.

And so, in summary—

We’ve identified areas to contribute in

Payments

Data

Lending

Investments

We think APIs are game-changers

They allow customisation of financial services

They are modular

They reduce cost of distribution

We partner with other businesses

Businesses know their customers best and can use our APIs like Lego blocks to build the best products.

Setu helps them further their mission by reducing red tape and integration effort.

Come work with us

Sold on the idea? Does working on nation-level problems interest and excite you?

We are always looking for talented folk to come onboard and make a difference in any way they can. We look for two prerequisites—curiosity and hunger. Ok, maybe three—humility as well.

It usually doesn’t matter if your particular skillset doesn’t match our currently open roles. We are more than happy to start a conversation and see where it can take us. Some of the best discoveries were coincidental, you know.